Standard payroll deductions calculator

Roughly 90 of taxpayers claim the. Use this handy tool to fine-tune your payroll information and deductions so you can provide your staff with accurate paychecks and get deductions right the first time around.

What Are Payroll Deductions Article

Itemized deductions comes down to claiming a flat dollar amount determined by the IRS or what you actually spent.

. Then enter the number of hours worked and the employees hourly rate. The amount can be hourly daily weekly monthly or even annual earnings. Use this payroll tax calculator to see how adding new employees will affect your payroll taxes.

This 250k after tax salary example includes Federal and State Tax table information based on the 2022 Tax Tables and uses Virginia State Tax tables for 2022The 250k after tax calculation includes certain defaults to provide a standard tax calculation for example the State of Virginia is used for. Include your federal and state deductions as well as your FICA and medicare deductions. The employee may participate in company benefits such as health insurance a health savings account or a retirement savings plan.

Calculate and print employee paychecks in all 50 states as well as Puerto Rico Guam Virgin Islands and American Samoa. The calculator will use those deductions when figuring your federal tax subtraction. Some of these payroll deductions are mandatory meaning that an employer is legally obligated to withhold.

There are a number of different payroll deductions that can be deducted from an employees paycheck each pay period. In some cases this calculation may be slightly off but the difference shouldnt be much. Standard Deduction for 2017 Federal.

Then you need to determine whether your available itemized deductions exceed the standard deduction for your filing status. For 2021 the standard deduction numbers to beat are. Standard deductions ensure that all taxpayers have at least some income that is not subject to federal income tax.

South Carolina Paycheck Calculator Calculate your take home pay after federal South Carolina taxes Updated for 2022 tax year on Aug 02 2022. As originally proposed these are not forgiven payments but rather deferred payments which need to be paid. Employers are required by law to pay mandatory deductions by sending them to tax agencies.

Mortgage Tax Benefits Calculator. For 2017 the standard deductions are. Usage of the Payroll Calculator.

The IRS issued Notice 2020-65 which allowed employers to suspect witholding and paying Social Security payroll taxes for salaried employees earning under 104000 per year through the remainder of 2020. Calculating payroll deductions doesnt have to be a headache. Enter your pay rate.

Calculating your Texas state income tax is similar to the steps we listed on our Federal paycheck calculator. Why Gusto Payroll and more Payroll. That flat amount is called a standard deduction Standard deduction basics.

The standard deduction dollar amount is 12950 for single households and 25900 for married couples filing. To try it out enter the workers details in the payroll calculator and select the hourly pay rate option. Automatic deductions and filings direct deposits W-2s and 1099s.

Standard deductions generally increase each year due to inflation. You can use the calculator to compare your salaries between 2017 and 2022. For those who do not use itemized deductions a standard deduction can be used.

Free calculator to find the actual paycheck amount taken home after taxes and deductions from salary or to learn more about income tax in the US. Ensure that you include local taxes if your city is one that enforces such deductions. No state-level payroll tax.

The calculator is updated with the tax rates of all Canadian provinces and territories. Cash flow is the lifeblood of any business an essential asset for your company to support everyday operations. Ellen is single over the age.

This 40k after tax salary example includes Federal and State Tax table information based on the 2022 Tax Tables and uses Utah State Tax tables for 2022The 40k after tax calculation includes certain defaults to provide a standard tax calculation for example the State of Utah is used for calculating state. Has standard deductions and exemptions. You have the option of claiming the standard deduction or itemizing your deductions.

These range from FICA taxes contributions to a retirement or 401k plan child support payments insurance premiums and uniform deductions. The choice between standard deduction vs. Federally mandated taxes such as FICA tax and federal income tax are standard payroll taxes that must be taken out from an employees paycheck.

US Tax Calculator and alter the settings to match your tax return in 2022. If your Oregon itemized deductions are less than the federal standard deduction the calculator will use the federal standard deduction when figuring the federal tax. Thats the normal standard deduction of 25900 for married taxpayers filing joint returns plus three additional standard deductions at 1400 apiece.

US Tax Calculator and alter the settings to match your tax return in 2022. In the deductions section of a paystub template be as descriptive and as accurate as possible. The hourly wage calculator accurately estimates net pay sometimes called take-home pay after overtime bonuses withholdings and deductions.

Health benefits automatic savings 401ks. 2022 state and local income tax rates. Many employers choose to use a payroll service provider in order to automate.

Work out your adjusted gross income Total annual income Adjustments Adjusted gross income calculate your taxable income Adjusted gross income Post-tax deductions Exemptions Taxable income. Run payroll for hourly salaried and tipped employees. Automatic deductions and filings direct deposits W-2s and 1099s.

That might sound like a lot of work but it can pay off if your total itemized deductions are higher than the standard deduction. Figure out your filing status. Proper payroll processing ensures that the correct.

Use this calculator tool to determine whether your present cash flow is enough to cover your needs for payroll loan payments inventory purchases and any other financial draws on your business resources.

How To Use The Cra Payroll Deductions Calculator Blog Avalon Accounting

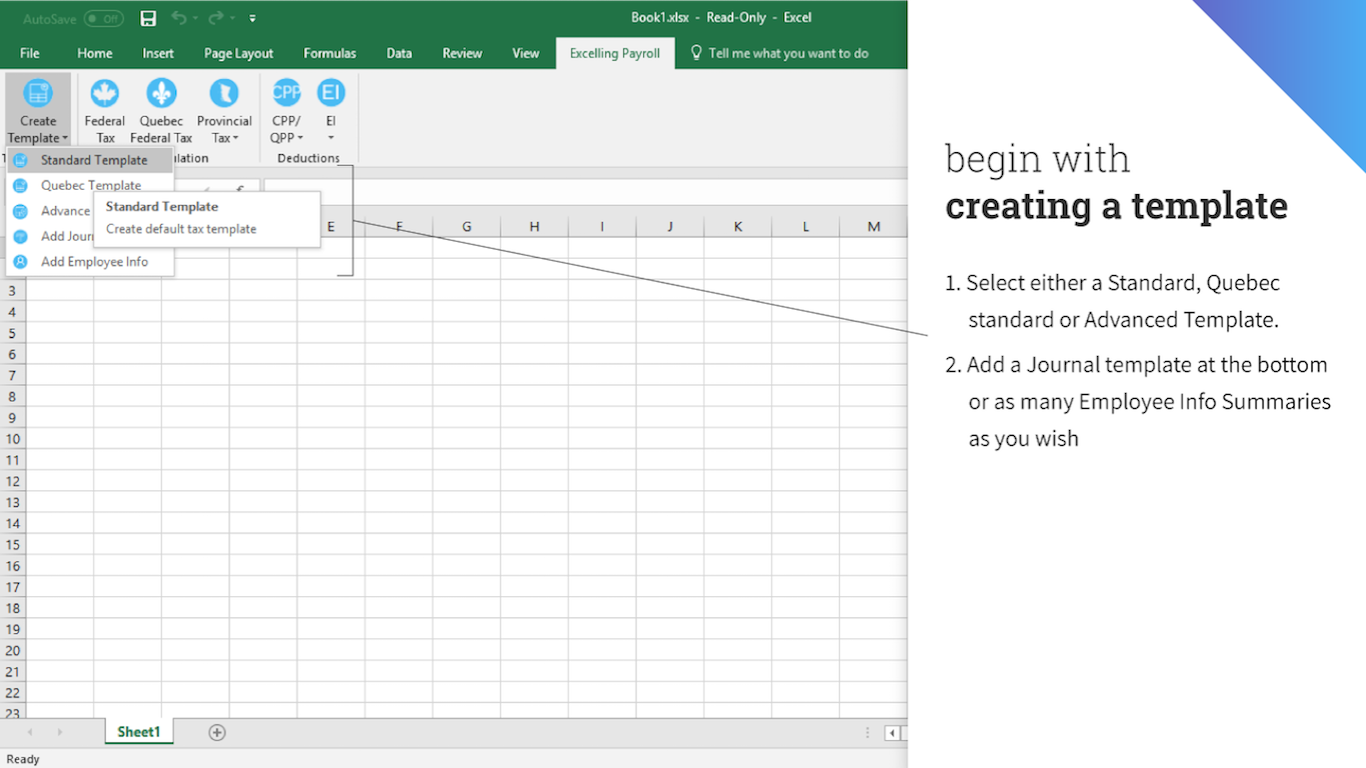

How To Do Payroll In Excel In 7 Steps Free Template

Calculation Of Federal Employment Taxes Payroll Services

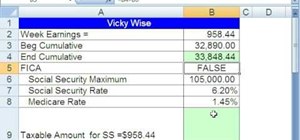

How To Calculate Payroll Deductions Given A Hurdle In Excel Microsoft Office Wonderhowto

Mathematics For Work And Everyday Life

Paycheck Calculator For Excel Paycheck Payroll Taxes Consumer Math

How To Use The Cra Payroll Deductions Calculator Blog Avalon Accounting

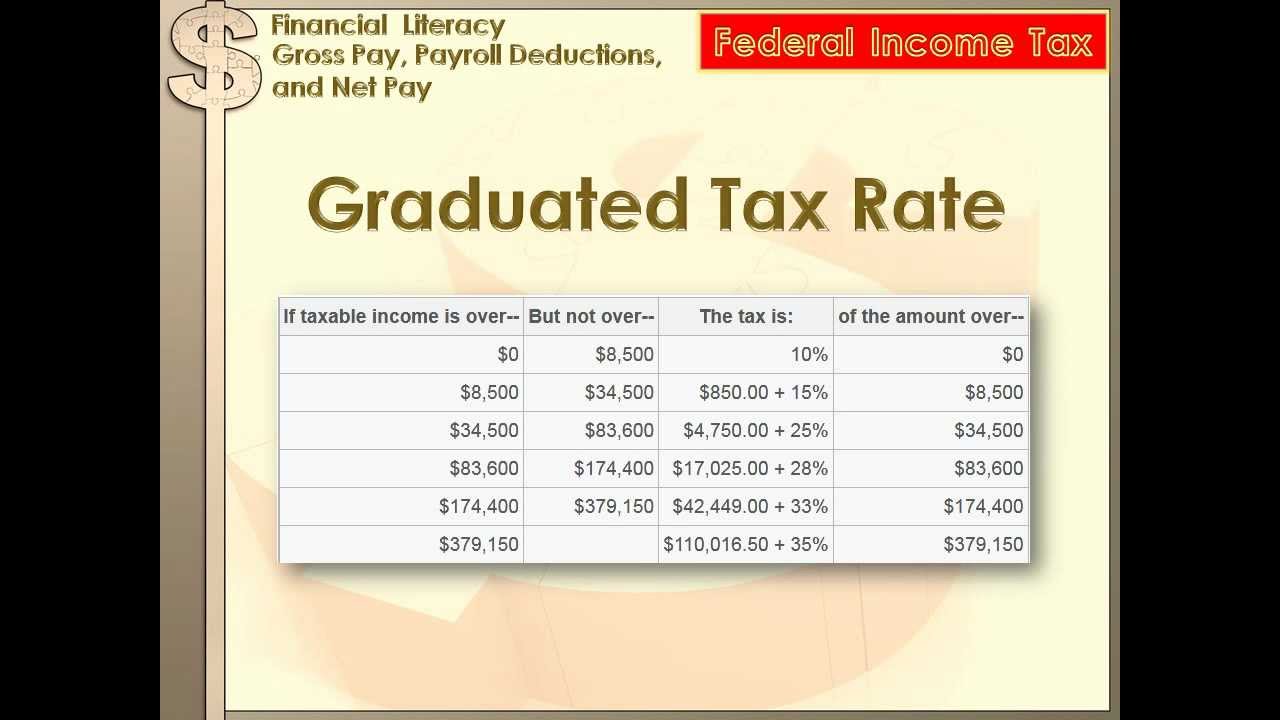

Financial Literacy Gross Pay Payroll Deductions Net Pay 8th Grade Math Youtube

How To Do Payroll In Excel In 7 Steps Free Template

Mathematics For Work And Everyday Life

The Basics Of Payroll Tax Withholding What Is Payroll Tax Withholding

Mathematics For Work And Everyday Life

Standard Deductions Youtube

Federal Income Tax Fit Percent Method How To Calculate Fit Using Percent Method Youtube

How To Use The Cra Payroll Deductions Calculator Blog Avalon Accounting

Payroll Tax What It Is How To Calculate It Bench Accounting

Find The Right App Microsoft Appsource